Why We Make Irrational Decisions: Behavioral Economics Explained

Human beings are not always the sane agents that economics says they are. Rather, we tend to make psychological, emotional, social and cognitive judgments. This is the premise of behavioural economics, which blends psychology and economics to explain why human beings seem to be acting out of delusion.

Key Concepts in Behavioral Economics

Bounded Rationality

Our rational decision-making is constrained by time, information and brain power. We don’t weigh everything very carefully, so we "heuristic," or short cuts ourselves to quickly and misstep.

Loss Aversion

We don’t like to lose, we don’t like to win. It is more painful to lose $10, for instance, than it is to discover $10. That’s prospect theory, the reason why human beings prefer not to lose than to gain.

Anchoring Effect

First data ("anchor") drives all the decisions afterwards. For example, if a price tag shows a discount of $100 to $50, you’ll think $50 is a great deal when in reality the thing actually costs about $30.

Confirmation Bias

We like and accept evidence that supports the things we already think, and we renounce or disbelieve it. This bias can encourage overestimation and wrong decisions.

Overconfidence

Everyone underestimates how much they know, or how much they are able to do, or how much they can influence what happens. It can make for bad choices like overinvesting in a failing business or not measuring up on timelines.

Social Influence

Almost everyone makes choices based on the actions of others. Herd psychology or peer pressure can account for things like stock-market bubbles or patterns in consumer spending.

Present Bias

We value the present a lot more than the future, and that is why we procrastinate or tend to spend more money without saving for the future.

Why Do We Make Irrational Decisions?

- Moral judgments: There are times when logical reasoning can be swayed by emotions such as fear, joy or anger.

- Cognitive overload: When we are stuffed with information or stress, our brain uses shortcuts, and not always the best ones.

- Routines and Habits: We stay put in an existing situation and don’t do it when it could be good for us.

- Frame Effects: Decisions are heavily influenced by the frame in which options are presented.

It is nice to say, for instance, that a surgery has "90% survival rate," but not "10% mortality rate," even though the numbers are the same.

Applications of Behavioral Economics

Marketing and Advertising

Companies use behavioural data to craft optimized ads, pricing, and product placement to make consumers act.

Public Policy

Governments prod people to make healthier choices, to put money aside for retirement or use less energy, simply by changing the presentation of the choices.

Financial Decision-Making

Behavioral economics gives an account of why people become indebted, don’t save, or spend too much, and how we can change this behaviour.

Where Do We Go From Here?

- Awareness: Becoming aware of biases is the first step towards defeating it.

- Time to consider: Taking the time to consider options can prevent impulses.

- Tools to help with decisions: Reminders, commitment trackers, professional support can help.

- Making Decisions Different: Thinking about choices differently will allow actions to be framed more positively in relation to the long term.

Mobile Security: Tips to Keep Your Phone Safe

Mobile Security: Tips to Keep Your Phone Safe

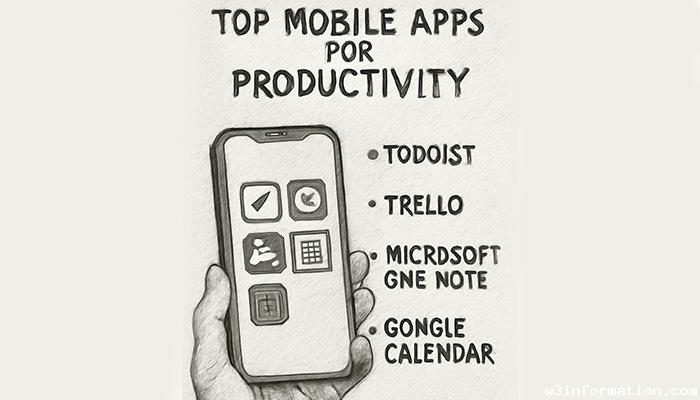

Top Mobile Apps for Productivity

Top Mobile Apps for Productivity

How to Optimize Your Mobile Battery Life

How to Optimize Your Mobile Battery Life

Mobile Gaming: The Best Games in 2025

Mobile Gaming: The Best Games in 2025

Comparing iOS vs Android

Comparing iOS vs Android

The Future of 5G in Mobile Phones

The Future of 5G in Mobile Phones