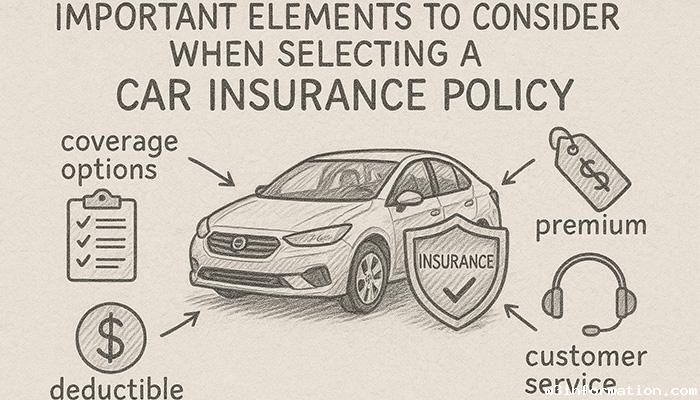

What to Look for in a Car Insurance Policy

The right car insurance policy selection protects you legally while safeguarding your finances and ensuring peace of mind. The wide variety of coverage options and providers together with different premium rates makes choosing a suitable policy for your needs a daunting task. Understanding the main features and important factors is essential to deciding wisely before finalizing your agreement. This section outlines essential features to evaluate in a car insurance policy.

Types of Coverage

Learn about the various coverage options that exist before proceeding further.

Liability Coverage:

Liability coverage protects you against the costs for damage or injury you cause to other people. A minimum liability insurance requirement exists in most states.

Collision Coverage:

Collision coverage pays for vehicle damage resulting from a collision without needing to prove who was at fault.

Comprehensive Coverage:

Comprehensive coverage applies to damage from events like theft and natural disasters unrelated to collisions.

Personal Injury Protection (PIP):

This insurance coverage covers medical costs for both you and your passengers no matter who caused the accident.

Uninsured/Underinsured Motorist Coverage:

This coverage offers protection when you're struck by a driver who lacks adequate insurance.

Knowing the coverage details of each plan allows you to select a policy that aligns with your driving patterns and risk factors.

Policy Limits

Insurance policies have payout limits. These elements establish the upper payment limit that your insurance company will disburse for claims that meet coverage criteria. Your policy should provide sufficient limits to manage extreme cases especially for liability claims that could lead to serious financial losses. Although higher policy limits lead to increased premiums they deliver enhanced protection for policyholders.

Deductibles

Your deductible represents your personal financial responsibility before insurance coverage begins. Choosing lower deductibles results in elevated monthly premium costs whereas opting for higher deductibles decreases your premium but requires greater out-of-pocket payment when making a claim. Select a deductible amount that aligns with both your financial resources and your comfort with risk.

Premium Costs

The lowest premium policy may not provide the best value for your needs. Carefully assess the benefits you receive compared to the premium amount you pay. Find insurance discounts through good driving habits, policy bundling, safety systems in vehicles, or driving fewer miles.

Customer Service and Claims Support

After an accident occurs you need an insurance provider that quickly responds to your needs and processes your claims with efficiency. Examine customer reviews and obtain ratings from reputable sources such as J.D. Power to determine the insurance company's standing in claims handling and customer satisfaction. Evaluate the insurance company’s credibility in claims management and customer contentment along with financial soundness through reviews from J.D. Power or AM Best.

Add-Ons and Extra Benefits

A variety of additional coverage options are available from many insurance companies to expand your policy protections.

Roadside assistance

Rental car reimbursement

Gap insurance will protect you if your vehicle's value falls below what you still owe.

No-claim bonus protection

Accident forgiveness

Evaluate these extra benefits to determine whether they meet your requirements and support the price increase.

Policy Exclusions

Always read the fine print. Certain policies will not cover particular damages or situations such as damage during racing activities, commercial vehicle use or natural disasters in specified areas. Understanding coverage limitations holds equal importance to knowing your policy benefits.

Flexibility and Policy Customization

Select an insurance company that offers policy customization options to match your personal lifestyle needs. Policies that let frequent travelers, students and family drivers adjust their coverage guarantee they pay only for their actual needs.

Conclusion

Comprehensive protection coverage along with affordable premiums and adaptable service options should mark the features of an excellent car insurance policy. Always compare insurance policies thoroughly and understand their details instead of settling for minimum coverage. Choosing the right car insurance protects you financially while giving you peace of mind during every drive.

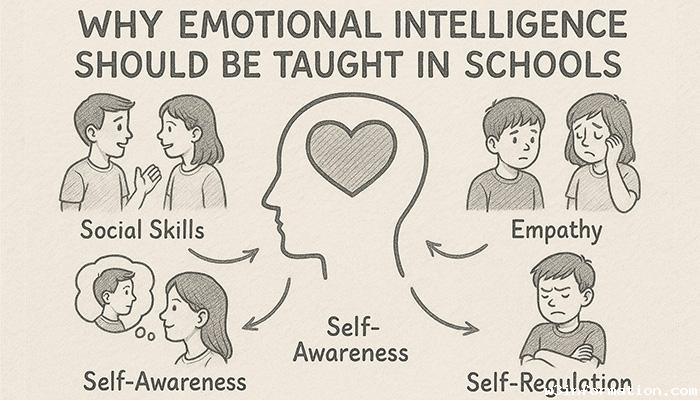

Why Emotional Intelligence Should Be Taught in Schools

Why Emotional Intelligence Should Be Taught in Schools

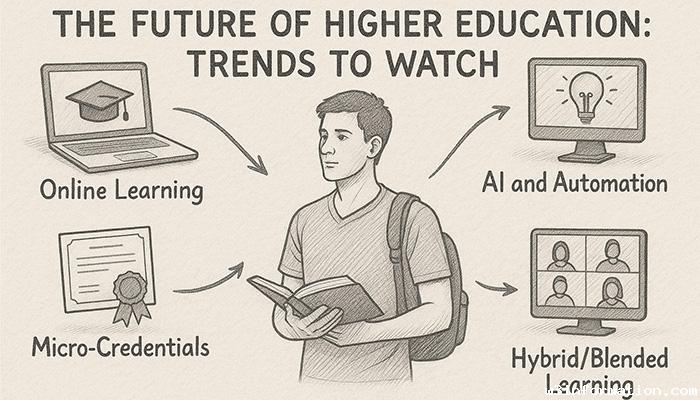

The Future of Higher Education: Trends to Watch

The Future of Higher Education: Trends to Watch

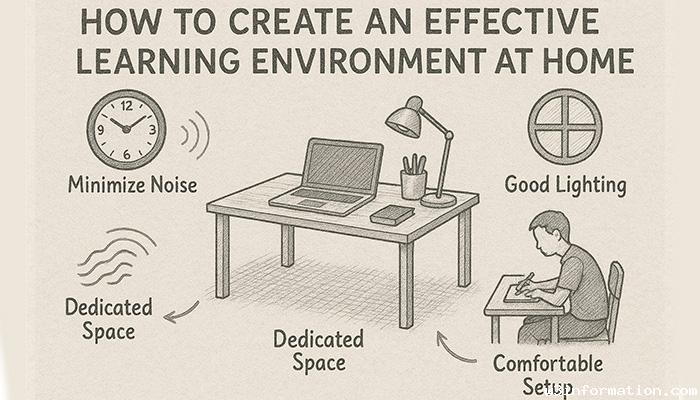

How to Create an Effective Learning Environment at Home

How to Create an Effective Learning Environment at Home

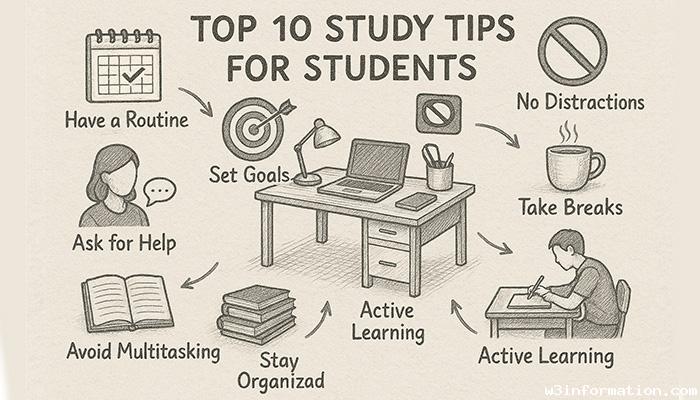

Top 10 Study Tips for Students

Top 10 Study Tips for Students

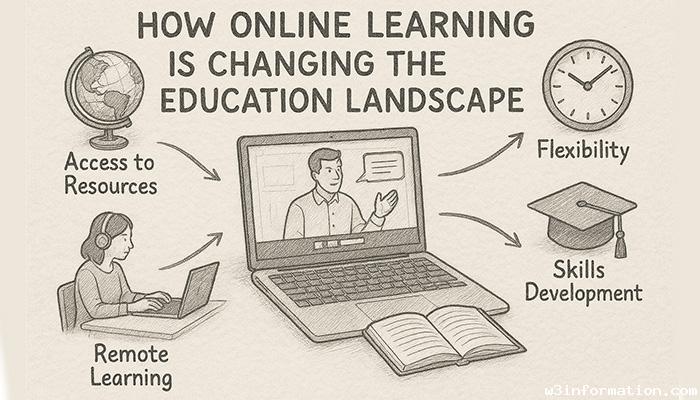

How Online Learning is Changing the Education Landscape

How Online Learning is Changing the Education Landscape

How to create backend CRM using React JS

How to create backend CRM using React JS